Cloud Costing - need for agility & co-creation

Changing FinOps landscape and a shift to SaaS

Cloud Cost Management has been the talk of the town. Well, I mean the town managing IT infrastructure. If you do not live here, you are good. As Covid accelerated digital transformations across organisations and reduced average employee tenure, cloud adoption also increased. While many small and medium scale organisations were born in cloud, enterprises faced (and continue to face) multiple questions – on-prem vs public cloud vs a mixture of both, AWS vs Azure vs GCP, workforce training, cloud cost management, migration planning being the major ones. For cloud management solution providers, this means new use cases and adoption challenges, which any market expansion brings with it.

Cloud spend is estimated to be $1 trillion by 2025. With organisations spending anywhere between 1% and 3% for cost management, there is a $15 billion(average) opportunity, expected to grow at 18% CAGR. But cloud cost management is not new. It has many relatively mature players. So why is cloud cost management the number one concern for businesses undergoing cloud transformation? For one, the FinOps practice in organisations is not ready to move from a CapEx(on-prem) to an OpEx(usage based Cloud) model. An OpEx model requires the FinOps to be agile, experimental, and embedded across multiple divisions. A “provision and forget” approach does not work.

To leverage the services provided by various cloud vendors, and to not depend entirely on one cloud, businesses are looking at a multi-cloud approach. Think about the complexity in case the cloud strategy involves a combination of on-prem and multiple public clouds. For instance, an e-commerce business may decide to have sensitive customer data on-prem, catalogue in one public cloud, and supply chain services (which require integrations with other 3rd party logistic solutions) in the other. FinOps in most organisations today is not ready to optimise cost for such a complex architecture. Without an accepted best practice, FinOps culture needs to evolve through multiple iterations to cater to a multi-cloud world.

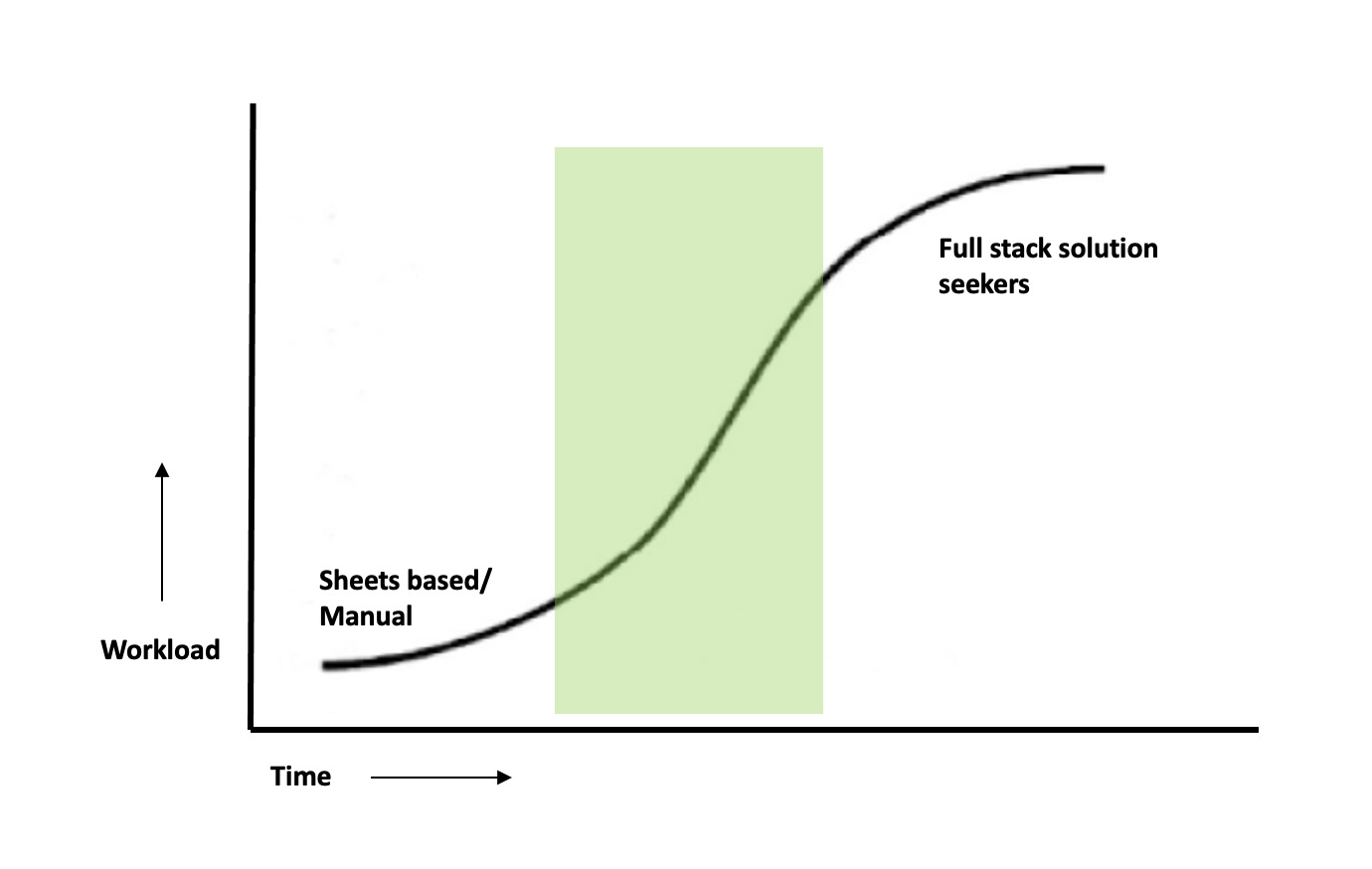

FinOps practices in organisations would evolve to different variations depending on the cloud strategy, business type (Service Providers vs Direct players) and cost maturity. For instance, FinOps at small enterprises with small workload may be managed by a developer, on an MS Excel sheet. On the other hand, large enterprises may have an army of Cloud Admins who are ready to build extensions for a custom stack catering to both ITOps and FinOps, providing a single pane of glass for the management.

The other major trend is the move to SaaS. Organisations – large or small are looking to a SaaS delivery model since their end customers/consumers are adopting SaaS applications to cut back on maintenance costs (on-prem may continue to have its place among more security conscious customers). A SaaS business is more dynamic, focusing on ROI metrics such as LTV, which require calculation of variable costs such as additional infrastructure cost, marketing cost, etc, and value provided by the customer. The involvement of multiple stakeholders leads to organisation structure specific variation, requiring further flexibility.

To build a solution which is flexible enough for both sides of the scale, a vendor needs to co-create with the customer and experiment rapidly. This is a good place to be for agile startups.

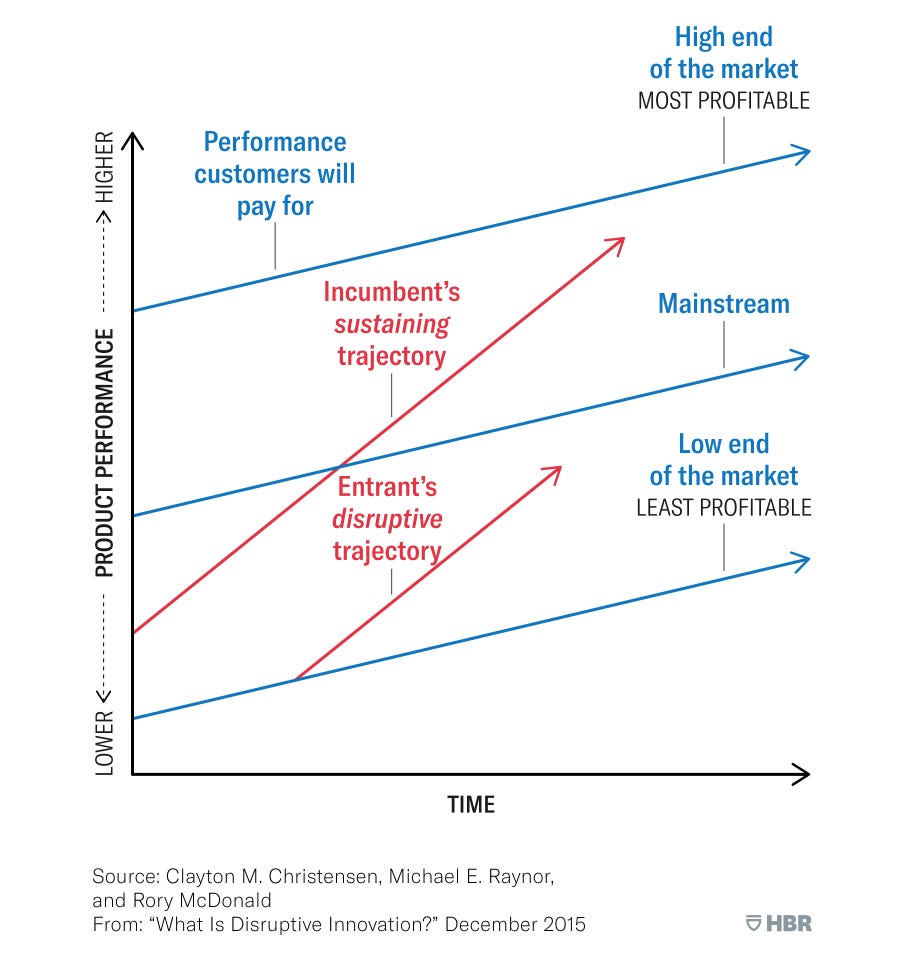

Enterprise Cost Management Solution providers, with relatively lower agility, end up prioritising the problems (such as RBAC) of its large customers, leaving the space open for smaller players or startups to cater to cost-optimisation hungry SMEs who may not be that averse to trying out new solutions. Startups go the extra mile to build more flexible and user-friendly solutions which would reduce the cost of training, a significant cost for businesses. Once they find product-market fit, they move to enterprise space with integrations to provide a full-stack solution for both ITOps and FinOps. Recent funding of cost management startups is an indication of the same. Watch this space. It will only get more interesting.

As I know, large cloud providers are building tools to cross manage competitor's clouds as well. The sophistication of the cross management tool is becoming one of the key differentiator. I wonder what a startup's offering be in such cases, since they have no edge or infact lag for access to large cloud infra compared to legacy companies.